With the overwhelming number of salary surveys available today, plus all the various scope cuts within those surveys, it can be difficult to know which surveys are right for you.

The beginning of our Compensation 101 series walked you through establishing a salary benchmark methodology unique to your organization and emphasized the importance of selecting salary surveys and documenting the relevant salary data cuts in a blending of methods to consistently and accurately conduct market pricing of your jobs.

Another equally important discussion when market pricing your jobs is knowing when and how to use general industry salary survey data along with industry-specific salary survey data.

What is the difference between general industry data and industry specific data?

General industry salary data is survey data for common jobs within a company, regardless of that company’s industry. This salary data would be for jobs in departments such as IT, Accounting, Marketing, or Human Resources. Industry-specific salary survey data covers jobs that are specific to a given industry, such as Nurses, Engineers, or Retail Associates.

Think of it like this: a Physician is very specific to the healthcare industry while a Marketing Manager could exist within any given industry. To be a Physician, medical school as well as healthcare industry experience is required. However, a Marketing Manager who has worked in healthcare could fairly easily take a job in another industry, such as Retail, and be able to successfully transfer the marketing skill.

General industry survey data

In a general industry survey, such as the US or Canada MBD: Mercer Benchmark Database, you have the option to refine your dataset by selecting from a set of industries (e.g., High Tech, Consumer Goods, Life Sciences). In the case of MBD, precision refinement involves taking the full dataset, which includes over 3,300 organizations for the US or 1,400 organizations for Canada, and filtering it down to those organizations that fit into specific industry categories. Any identified salary data subset, in many surveys, can then be narrowed further to reflect only the size and/or location of companies that are relevant to your organization or the jobs you are market pricing.

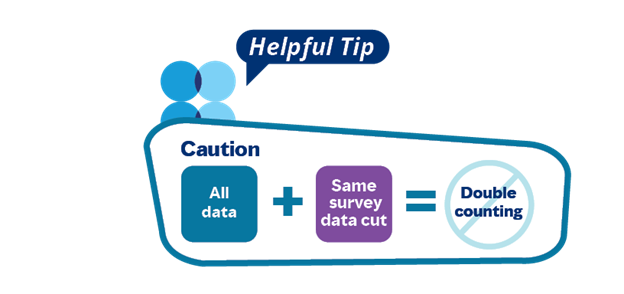

When using refined salary data cuts from general industry salary surveys, you need to consider how you plan to use them. Keep in mind, to avoid double counting, salary data cuts from the same survey should not overlap. For example, if you choose to use the "Industry: Finance" cut, you will want to avoid using the "All Data" cut when market pricing the same jobs. The responses from any company that is in the Finance industry are also in the “All Data” cut. Typically, if more than one data scope cut is made from the same salary survey, each cut should reflect different jobs or employee segments.

Industry-specific survey data

In an industry-specific survey, such as the US or Canada MTCS: Mercer Total Compensation Survey for the Energy Sector, the dataset includes only those positions that identify within the particular industry. Oftentimes, the overall participant set is smaller than in general industry salary surveys, but that is by design.

The benefits of industry-specific salary surveys include:

- You will likely find a larger number of survey participants that are in the relevant industry than you would in a general industry salary survey, and this larger pool could be filtered by industry. That means more statistically significant data.

- When looking for industry-specific jobs, you’ll find more jobs or variations of jobs in an industry-specific salary survey.

- Industry-specific salary surveys frequently include policy and practice information, which will capture practices that differ from the broader industry. For example, only in healthcare surveys will you find information on all the various types of pay that apply to nurses.

Next steps to survey data planning

When using industry-specific salary surveys, you are typically applying those data points to specific employee segments or jobs within your organization — those that require industry experience. If you choose to blend industry-specific salary survey data with a cut from a general industry salary survey, you'd typically also be utilizing the data refined by industry scope, to achieve the goal of diversifying your data sources.1

Effectively using salary survey data and all the various scope cuts and data elements can be challenging. And consistency is key. Developing your compensation philosophy and benchmark methodology first will help you stay consistent. From there you can effectively use our comprehensive set of general industry and industry specific salary surveys. Best of luck to you!

Need help developing your benchmark methodology? Check out the article Establishing a Benchmark Methodology Unique to Your Organization within this Compensation 101 series for some helpful tips and tricks.

1 Best practice is to attempt to collect at least three data points for each job when market pricing.