Back to school and the changing of leaves signify it’s that time of year – the compensation planning season. I think we’ve come to expect very little change, if not a slight downward trend, but will this year be different? Let’s take a look!

Economic impact on compensation decisions

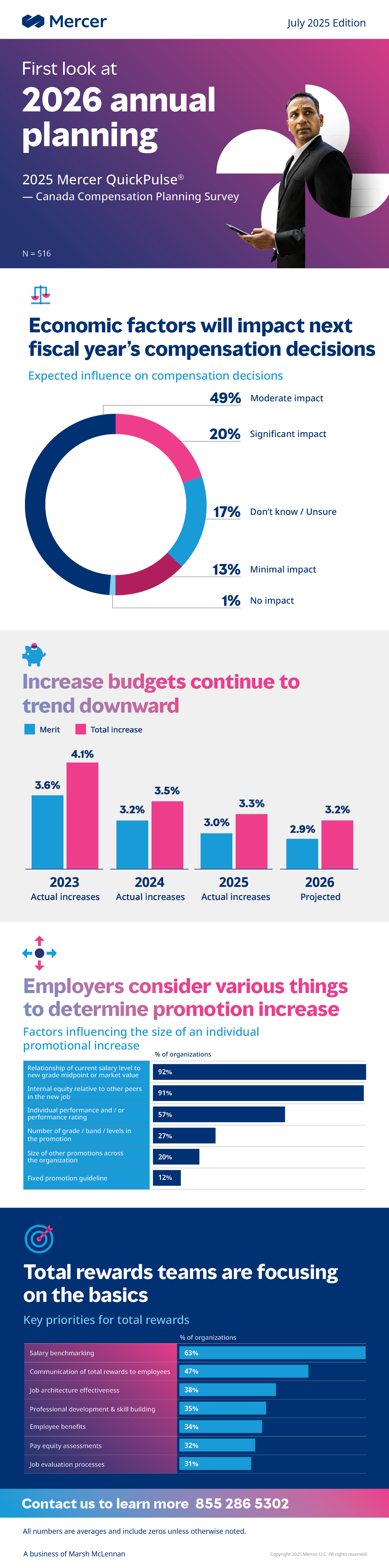

A bit more than 500 Canadian companies participated in the 2025 Mercer QuickPulse® - Canada Compensation Planning Survey , July edition. Nearly 70% of companies expect a moderate to significant impact on their compensation decisions due to economic factors.

Is that impacting their preliminary increase budgets?

Merit and total increase budgets

Our data collection period was July 14 – July 25, 2025, and as of that time 90% of respondents indicated they are in the preliminary phase and have started collecting data to determine their annual increase budgets. Keeping that in mind, the national mean, including zeros for merit increases in Canada is expected to be 2.9% for 2026. For total increase budgets, which include merit, promotional, off-cycle increases, etc., the national mean is 3.2%. Both of these are just below the actual increases delivered for the 2024 performance year in the first quarter of 2025.

In Canada, publicly traded companies are projecting a mean merit increase of 2.8%, while privately owned and crown corporations are projecting 3.0%.

As for industries, High-tech and Insurance/Reinsurance stand out for both having their total rewards budget above the national average (3.2%) at 3.5%.

For the past several years, this initial projection has tended to be slightly different, typically higher, than what companies project in October, and finally deliver in Q1 of the new year.

Promotions

Employers are projecting that they will promote 8.7% of the employee population, on average, in 2026. This is down from the 9.8% they actually promoted in 2024, which exceeded their projection in August of 2024 (7.5%). It will be interesting to see how much of the population was actually promoted this year – you can find that in the March 2026 version of the Compensation Planning survey .

Canadian employers consider a variety of things when it comes to determining the size of the monetary increase accompanying a promotion. The most common are:

- Relationship of current salary level to new grade midpoint or market value,

- internal equity relative to other peers in the new jobs,

- and individual performance and/or performance rating.

Hot topics of today

As we mentioned, of course we asked about the impact of the economy – it’s certainly a ‘hot topic’!

Specifically, organizations expect certain things to increase in importance with skill & talent development, market competitiveness, and compensation changes being among the top responses. As for things that will become less of priority, hiring was mentioned the most, but only by 16% of respondents.

Canadian HR teams are focusing on salary benchmarking (63%), communication of total rewards to employees (47%), followed by job architecture effectiveness (38%). A few other basics round out the top six. The lowest selected option was employee listening (10%).

As for pay transparency, just under 60% comply with laws and do not plan to broaden transparency beyond what is required. However, the number of respondents that are including pay ranges in jobs postings nationally has increased from 16% in 2024 to 20% today. This reflects that Ontario is introducing pay transparency legislation on January 1, 2026 which will required ranges in job postings.

Looking ahead

If you have a fiscal year ending in December, you’re likely spending the next couple of months coordinating with finance and your leadership team to develop your merit and total increase budgets. That means refreshing salary benchmarking, identifying current versus target market positioning, assessing performance, developing budgets amongst many other activities.

Our next Compensation Planning survey opens for participation mid-October. By participating you will receive the revised, further developed merit and total increase projections along with all the other responses in the report at no cost to you.

Sign up to be notified when the next survey opens and give us a call at 855-286-5302 for additional assistance.

1All projections are means, including zeros.