Over the past several years, Canadian organizations have slightly reduced budgets and the projections for 2025 continue that trend. The next version of the Mercer QuickPulse® Compensation Planning Survey, to be released in November, will give us a better view.

Although a wide range of topics are covered in the full survey, for now, let’s take a look at what the almost 600 Canadian organizations provided as their original budget projections as well as how they are handling promotions and pay transparency.

Base pay changes

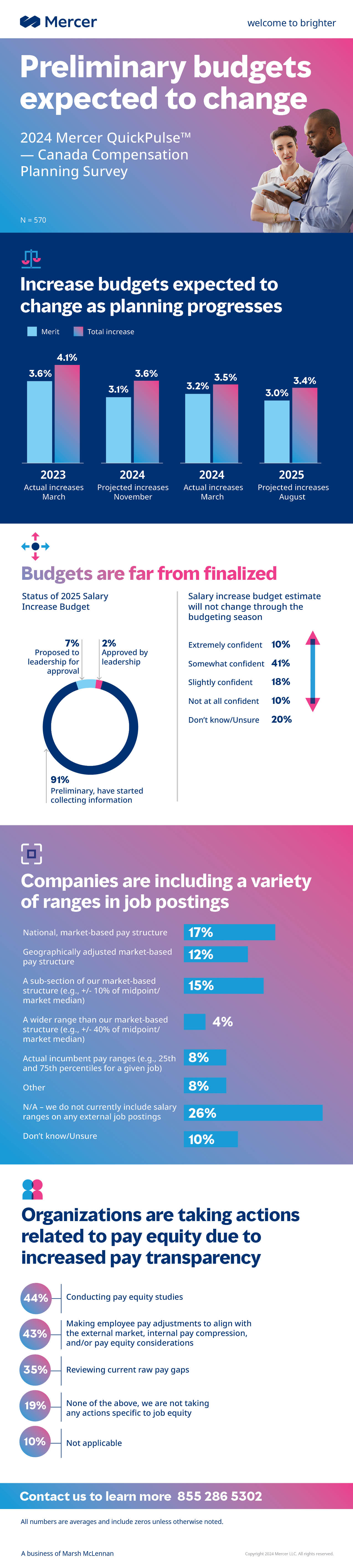

“Preliminary” is how 91% of respondents categorized the status of their 2025 salary increase budget. The projected 2025 merit increase budget and total increase budget of 3.0% and 3.4% (including zeroes), respectively, are lower than what was reported as the actual increases delivered in March 2024. Come November 2024 and March 2025, we will see what is finally budgeted and then delivered.

There are some differences between industries in merit budget forecasts. Chemicals is predicting a 3.4% merit increase budget while Energy and Banking/Financial Services are predicting 2.8% and Mining & Metals, 2.6%.

The delivery of pay increases outside of the annual process seems to have stopped. In March of 2024, the average total increases delivered was 3.5%. When we look at how much same incumbent pay has changed between January 1 and June 30, 2024, which would include that 3.5% increase, we see an average change of only 3.4%. Although the methodologies differ, it is clear that employers are no longer providing market adjustments or other pay increases meant to retain employees at the rates they were in 2021 and 2022.

Additionally, companies are not seeing the need to differentiate budgets by leaders or business units. Three quarters of the companies reported that all leaders or business units receive the same budget (i.e., a percentage based on their salary budget).

Additionally, companies are not seeing the need to differentiate budgets by leaders or business units. Three quarters of the companies reported that all leaders or business units receive the same budget (i.e., a percentage based on their salary budget).

Promotions

Employers are planning to promote 7.5% of employees in 2025, which is down from the 8% they planned to promote in 2024. For companies that have a separate promotional budget, the average promotional increase budget for 2025 is 1.1% (excluding zeros).

This time, Mercer asked about the frequency of promotions. Almost half of respondents said they don’t do promotions at a focal point during the year, but do them “as needed.” Just over a quarter of the respondents limit promotion cycles to once per year.

Interestingly, employers are increasingly providing pay increases for lateral job changes often, assuming certain conditions are met.

Pay transparency and equity

It’s safe to say that organizations and employees have accepted pay transparency as the norm. While they are, of course, complying with laws, 25% are exploring sharing pay ranges beyond what’s required by law. Another 15% replied that they already share pay ranges both internally and externally in a standard way.

A few outstanding questions continue to be asked by employers about pay transparency, mostly due to the ambiguity of the laws.

The first question is, when a job is fully remote, do employers still provide a salary range in the job posting? Twenty-one percent of employers said they post salary ranges for all remote jobs. Thirty-three percent said they only include ranges when the remote job is associated with an office location where it is legally required.

The second question is, what salary range is included in the job posting? Fifty-one percent of employers are only including salary ranges on postings where legally required and another 18% are sharing ranges nationally in job postings.

When they are sharing ranges, Canadian companies are including some of the following in job postings:

- National, market-based pay structure — 17%

- Geographically adjusted market-based pay structure — 12%

- A subsection of our market-based structure (e.g., +/- 10% of midpoint/market median) — 15%

Employers do recognize that pay transparency requirements will continue to expand not only nationally, but globally. Some of the most common actions they are taking to prepare are assessing the competitiveness of their pay levels and/or compensation structures, enhancing the job architecture for greater consistency and alignment with work being performed, and conducting pay equity studies.

Stay tuned

How does this all relate to what you’re doing in your organization? As for 2025 plans, don’t miss out on the next Mercer QuickPulse® Compensation Planning Survey, which opens on October 21. If you participate in the survey, you will be sent the results at no cost.

Have additional questions? Give us a call at 855-286-5302 or send us an email.